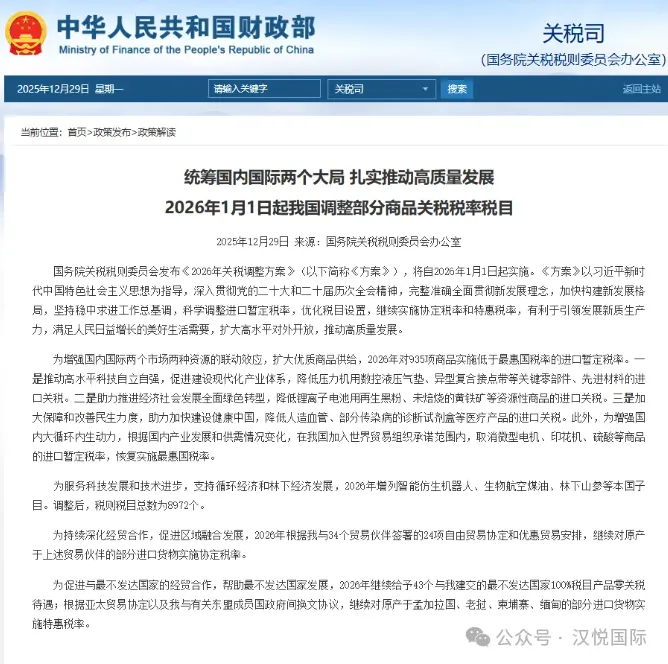

On December 29, 2025, the Tariff Commission of the State Council issued the "2026 Tariff Adjustment Plan", which will come into effect on January 1, 2026. Among them, the import tariffs on 935 items of goods will be reduced. Overview of Tariff Adjustments

According to the "2026 Tariff Adjustment Plan", this adjustment mainly includes several aspects such as provisional import tariff rates, agreement tariff rates and preferential tariff rates, forming a comprehensive and systematic tariff policy system. Next year, China will implement provisional import tariff rates lower than the most-favored-nation rates for 935 items. This adjustment mainly covers three areas: key components, resource-based commodities and medical products. Specifically, the import tariffs on key components and advanced materials such as CNC hydraulic cushions and special-shaped composite contact belts for presses will be reduced to promote the construction of a modern industrial system. To facilitate the comprehensive green transformation of economic and social development, the import tariffs on resource commodities such as recycled black powder for lithium-ion batteries and unroasted pyrite will also be reduced. At the same time, import tariffs on medical products such as artificial blood vessels and diagnostic kits for some infectious diseases will be reduced to help accelerate the building of a Healthy China. It is worth noting that not all tariffs on goods are being reduced. In light of changes in domestic industrial development and supply and demand conditions, China has, within the scope of its commitments upon joining the World Trade Organization, cancelled the provisional import tariff rates on goods such as micro motors, printing machines and sulfuric acid, and restored the most-favored-nation tariff rates. Zero-tariff treatment for 43 countries

Among the various tariff adjustments, the continuation of zero-tariff treatment for 100% of the product categories of 43 least developed countries has attracted much attention. This policy will continue to be implemented starting from January 1, 2026, demonstrating China's commitment to promoting economic and trade cooperation with the least developed countries and assisting their development. These 43 countries are all least developed countries that have established diplomatic relations with China. All the products they export to China can enjoy zero-tariff treatment. This arrangement falls under the category of preferential tax rates. However, there is an exception in its implementation: for goods subject to tariff quotas, only the tariff rate within the quota is reduced to zero, while the tariff rate outside the quota remains unchanged. In addition to the inclusive policies for the 43 least developed countries, based on the Asia-Pacific Trade Agreement and the inter-governmental exchange agreements between our country and the relevant member states of the Association of Southeast Asian Nations, our country continues to apply preferential tax rates to certain imported goods originating from Bangladesh, Laos, Cambodia and Myanmar. Continuation of the agreed tariff rates

In addition to the preferential tax rates, our country will continue to apply the agreed-upon tax rates to certain imported goods originating from 34 trading partners through 24 free trade agreements and preferential trade arrangements signed with them as of 2026. This will promote regional integration and further deepen economic and trade cooperation. The specific implementation is divided into two scenarios: One is to further reduce tariffs based on the contents of relevant agreements, including the free trade agreements between China and New Zealand, Peru, Switzerland, South Korea, etc., as well as the Regional Comprehensive Economic Partnership Agreement (RCEP). Second, for the imported goods that have already undergone tax reduction, the corresponding agreement rates will continue to be applied. This covers free trade agreements between China and ASEAN, Chile, Singapore, as well as the more closely integrated economic and trade arrangements between the mainland and Hong Kong, Macao (CEPA). The continuation and implementation of these preferential tariff rates demonstrate China's determination to uphold the multilateral trading system and promote regional economic integration. TIPS The 2026 tariff adjustment is not merely a simple increase or decrease in tax rates; rather, it represents China's proactive move under the double pressure of "global trade restructuring and domestic transformation": through greater openness to drive deeper reforms, and by leveraging its own market to provide impetus for global sustainable development. Han Yue International will continue to monitor the latest policies,providing cargo owners with optimal analysis and transportation solutions to help them maintain stable performance in a complex shipping environment. For the latest information or customized solutions, please contact our customer service.